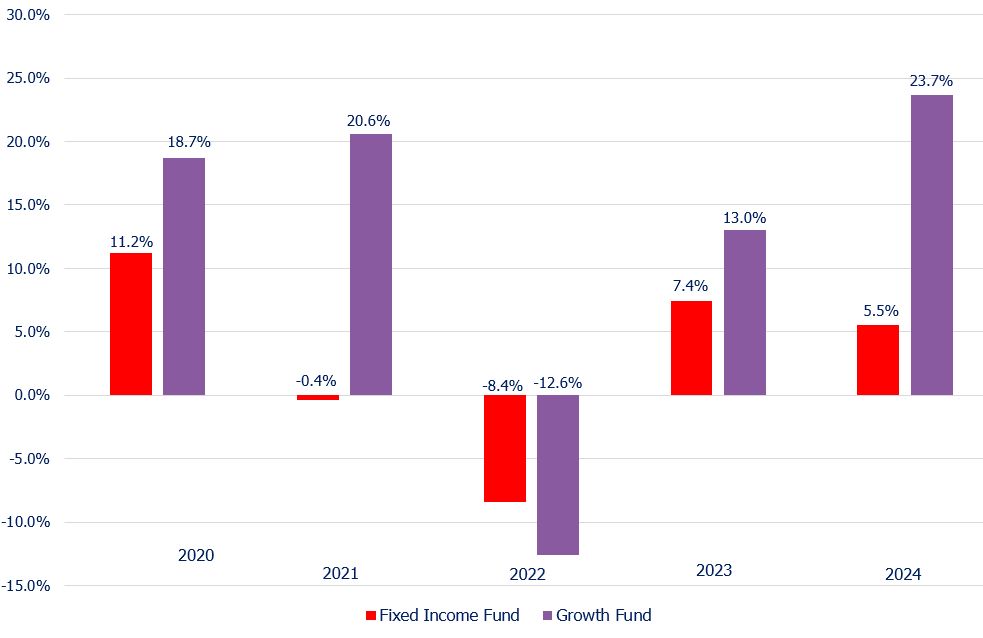

Individual Results

The return indicated on each member statement is a combination of the funds, based on that member’s balance in each, and the respective monthly earnings, less approximately 0.9% for plan expenses. Remember that assets in individual member accounts are allocated between these two funds based on the member’s age, so everyone will experience a slightly different combined return based on the allocation.