2025 Premium Rates

The Benefits Premium Rates for 2025 have now been published on the GSI website.

You can access them on the Premium Rates page.

Group Benefits Cost Trends

Why Do the Premiums Keep Going Up?

Inflation in the health care industry continues to rise at a rate above the standard cost of living. Canada-wide, employers are seeing increases to their benefits programs of 8% to 12%. There are many good reasons for this:

- Prescription drugs are the biggest driver of the inflation increase. Amazing new drugs are coming on the market that can transform the lives of those who previously had been deemed untreatable.

- Increased awareness of the need for mental health care has caused many plans to increase the psychology and counselling benefit. Access to this counselling can make a huge difference in the workplace for the well-being and productivity of the employees.

- Most of the benefits covered (dental, vision care, and professional services such as chiropractors and physiotherapists) are becoming more expensive. All of these benefits have lingering effects of the pandemic, with a higher level of service delivery.

In addition to these cost drivers, we know that as we age, we tend to have higher medical expenses. The average age in the ELCIC plan membership continues to increase. Having a good benefits plan can encourage employees to remain healthy and actively at work.

In addition to these cost drivers, we know that as we age, we tend to have higher medical expenses. The average age in the ELCIC plan membership continues to increase. Having a good benefits plan can encourage employees to remain healthy and actively at work.

Benefits Reserve Subsidy

The increase in the ELCIC Group Benefits Plan for 2025 has been set at 9%, both for the Health Modules and LifePlus. This premium increase has been mitigated with a subsidy from the benefits reserve fund; GSI is paying more than the additional 9% to Manulife for the Plan.

At this point, GSI anticipates that health care inflation will continue at the current rate, and we expect the increase in 2026 will again be higher than cost of living. With that in mind and with diminishing reserves, the subsidy likely won’t be available again next year.

Better Health for Greater Capability

We know that this increase will present a hardship for congregations. For congregations — as for most faith-based organizations — salaries, pension, and benefits represent a high proportion of annual expenses.

The ELCIC Plan premiums are a reflection of the plan claims. These are high because the plan is well used. (See, for example, the statistics piece below.) Plan Members and their families are able to seek proactive care and as a result, employees in the ELCIC are healthier and more capable of caring for parishioners, leading Sunday worship, participating in outreach programs, and being active members of the communities they serve.

A Few Reminders for Treasurers

- Life Events – It is extremely important that you contact GSI whenever there are any employment transitions. The benefits contracts and pension regulations have very specific requirements that we are bound by, and it can create liabilities if not followed.

- Life Taxable Benefit – GSI will be sending a report (if applicable) to all Treasurers with the amount that should be included as a taxable benefit on the T4. We expect to send this report in the second half of December. Also, be sure to calculate the taxable benefit for 2025 using the form on GSI’s website and make the appropriate monthly withholding.

- Amount Received – A report detailing all the 2024 contributions and premiums GSI has received will be sent in the later part of January 2025. Please watch for it and match it to your records. **Any differences between these two reports and your records should be brought to our attention.**

Please remember to send us your updated salary calculation forms for 2025 as soon as the salary is approved. We recommend approving the salary prior to its effective date in order to avoid complex retroactive calculations.

Please remember to send us your updated salary calculation forms for 2025 as soon as the salary is approved. We recommend approving the salary prior to its effective date in order to avoid complex retroactive calculations.- We recommend that employers keep records of vacation and sick time. Often when your employee has a medical absence that transitions to a short-term disability or when the employee resigns, we find that determining these entitlements and making appropriate and correct calculations is challenging.

- Eligibility for pension and benefits is the monthly 25% of YMPE (no hours requirement). Once eligible, enrollment is required with no waiting period.

This applies to all people for whom the employer remits statutory deductions (tax + CPP + EI). The calculation for YMPE for 2025 is available on this page under “Employee Eligibility & Enrollment Dates.”

Seeking Board Directors

Fall is in the air, and we are planning for the great work and opportunities before us. Having a full board with diverse thoughts and ideas makes for the best decisions, and right now we have a vacancy. Would you be interested in applying, or do you know someone who might be?

Skills of Special Interest

Terms are expiring soon for Directors who have particular expertise in the areas of investments and pension plans. Potential directors who have those particular skills would be especially valuable. However, the Board would also welcome candidates who are knowledgeable about other areas of relevance to GSI: benefits plans, policy and governance, the ELCIC, and communications.

One spot is reserved for a Plan Member: ideally for a Non-Rostered Plan Member, to ensure we also hear that voice. If you’re a Plan Member — and especially if you’re a Non-Rostered Plan Member — please consider applying to join the Board.

Or if you don’t think this is for you, send this ad to a colleague who you think might suit the role well.

Representation Matters

GSI’s Directors are members of ELCIC congregations. They live across the country and bring knowledge about their synods and their local contexts in addition to their areas of special expertise.

Having Plan Members, treasurers, and members of congregations serving on the Board is a real strength of the ELCIC Group Pension and Benefits Plans. The Board is responsible for making difficult decisions that will keep the Plans sustainable while keeping in mind the best interests of the rostered leaders and non-rostered employees in the ELCIC.

It’s important that a range of stakeholder groups have a seat at the table — including Plan Members and treasurers.

Where to Learn More?

You can read more about what is required of Board Directors and find the application form on the GSI Board of Directors page on the GSI website.

Selection of Benefits Module for 2025

As we move to the end of the year, members will have the opportunity to reflect on their benefits needs. Members can move to an adjacent module (e.g., from green to teal) that would start on January 1st by filling in a Group Benefits Enrollment form and submitting it to the GSI office. The deadline is Monday December 9, 2024.

This is a good time to meet with your rostered and non-rostered employees to see if they plan on making any changes, and then discuss how any additional premiums will be paid. Employers are required to provide their employees with the Blue module. Any other arrangements are as per the agreement between the employer and plan member.

Plan Usage: Some Statistics about Professional Services

Mental Health is one of the top five concerns of Canadian employees surveyed by Mercer in 2023. The survey also found that one-third of short-term disability claims were for mental health, and 56% of those were related to depression and anxiety.

The GSI Directors have taken this seriously by being a leader in providing generous resources within the group benefits plan. This past years’ experience, shown in the chart and graphs below, indicates that these resources are being well used.

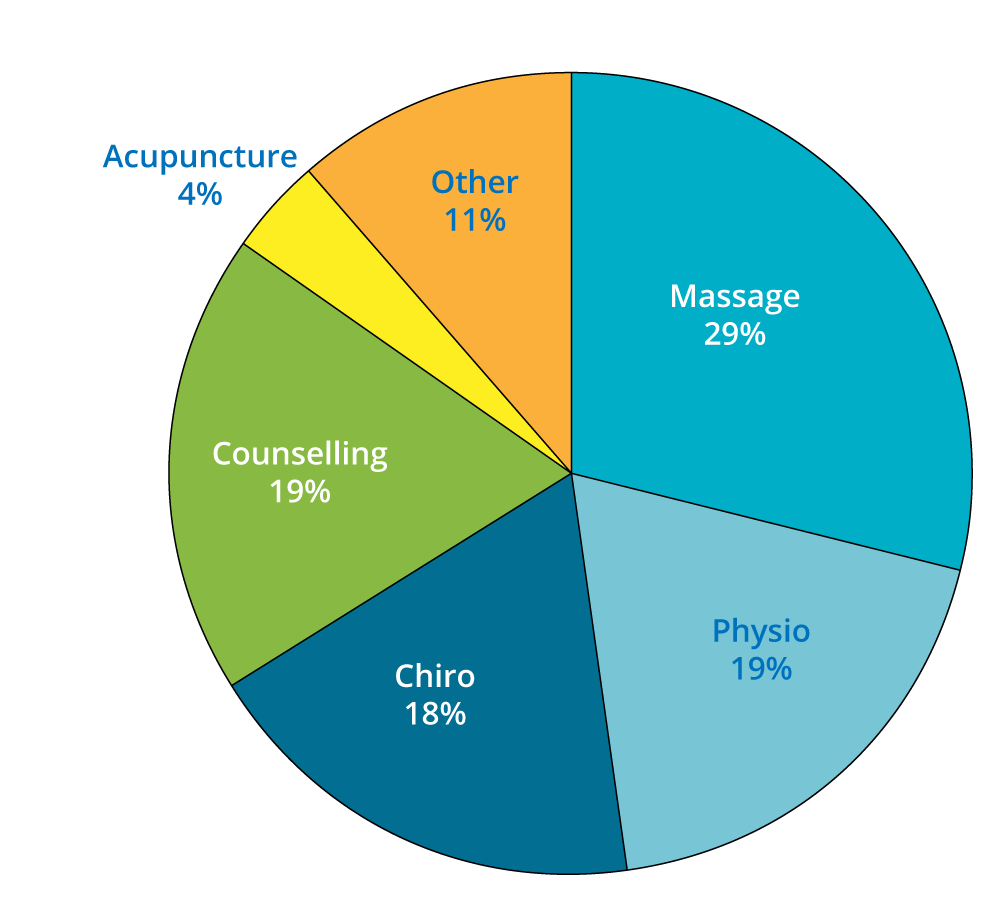

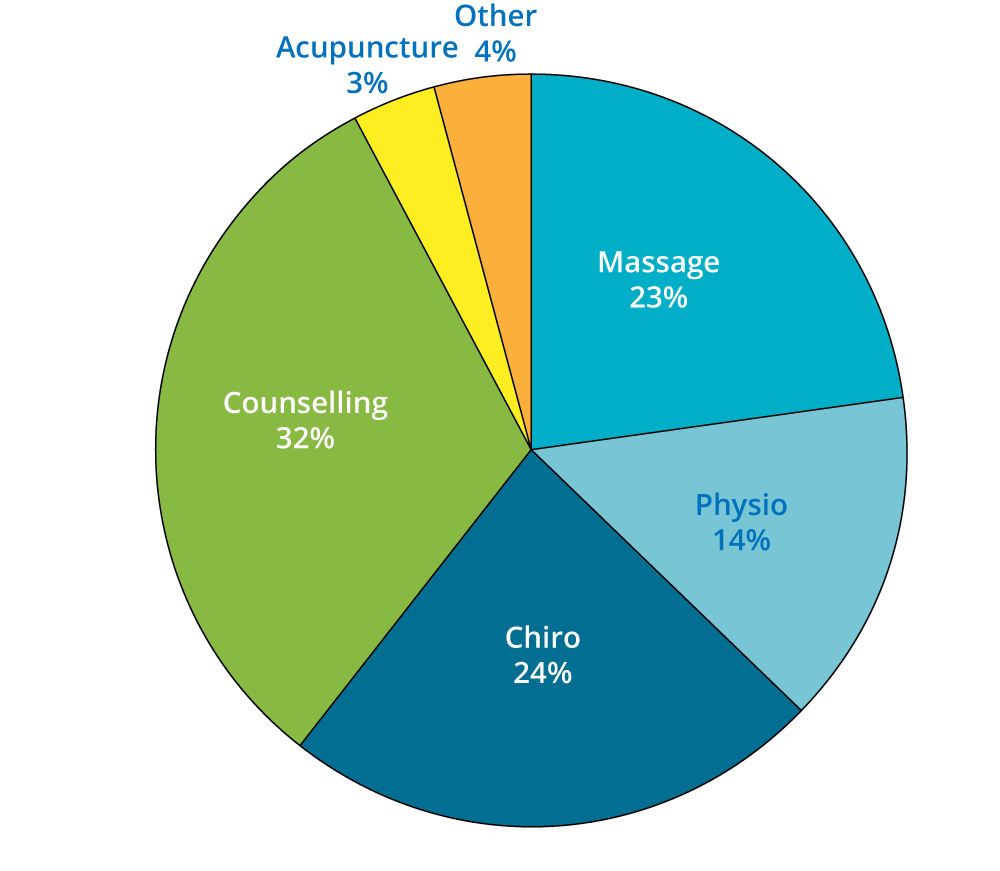

The breakdown by number of visits and number of claimants is interesting. Across the professional services, 782 claimants made a total of 3946 visits.

Number of Claimants

Number of Visits

The benchmark of Mercer’s clients overall sees massage as representing 30% of claims cost, with counselling at just 14%. In the ELCIC plan, counselling is the most used professional service, at 53%, followed by massage at 19%. This suggests that those who serve in the ELCIC have either greater need for counselling (due to the nature of their work) or greater awareness of its value and willingness to seek it out. Both are probably true.

The benchmark of Mercer’s clients overall sees massage as representing 30% of claims cost, with counselling at just 14%. In the ELCIC plan, counselling is the most used professional service, at 53%, followed by massage at 19%. This suggests that those who serve in the ELCIC have either greater need for counselling (due to the nature of their work) or greater awareness of its value and willingness to seek it out. Both are probably true.

The high number of claimants making use of counselling relative to other services again suggests that members in the ELCIC Group Benefits Plan value this benefit and are glad to be able to use it.

Relationship between Treasurers and GSI

Maybe you are new to the Treasurer role. If you have been at it for a while, maybe you have not thought about the relationship with ELCIC Group Services Inc. (GSI) in some time. GSI is a part of the ELCIC and was created to sponsor the pension and benefits plans on behalf of all ELCIC employers.

What is a Plan Sponsor?

A plan sponsor establishes and designs the plans. It monitors industry trends and the changing needs of their membership and adjusts their plans accordingly.

In the ELCIC, GSI as benefits plan policy holder manages contracts with insurers; employers sign subscription agreements.

As the pension plan sponsor and Administrator, GSI manages the pension plan; employers sign participation agreements.

What is a the Purpose of the Plans?

The little chart below shows why pension and benefits plans are both needed.

Pension Plan

To provide Plan Members with retirement income at a predictable cost to employers.

Group Benefits Plan

To provide coverage for essential medical needs not provided by the province—like prescriptions, dental, and vision care—helping employees and their families stay healthy. Also to help protect members from high healthcare costs due to illness or accidents at any age.

These plans help congregations and other related ELCIC organizations recruit and retain employees.

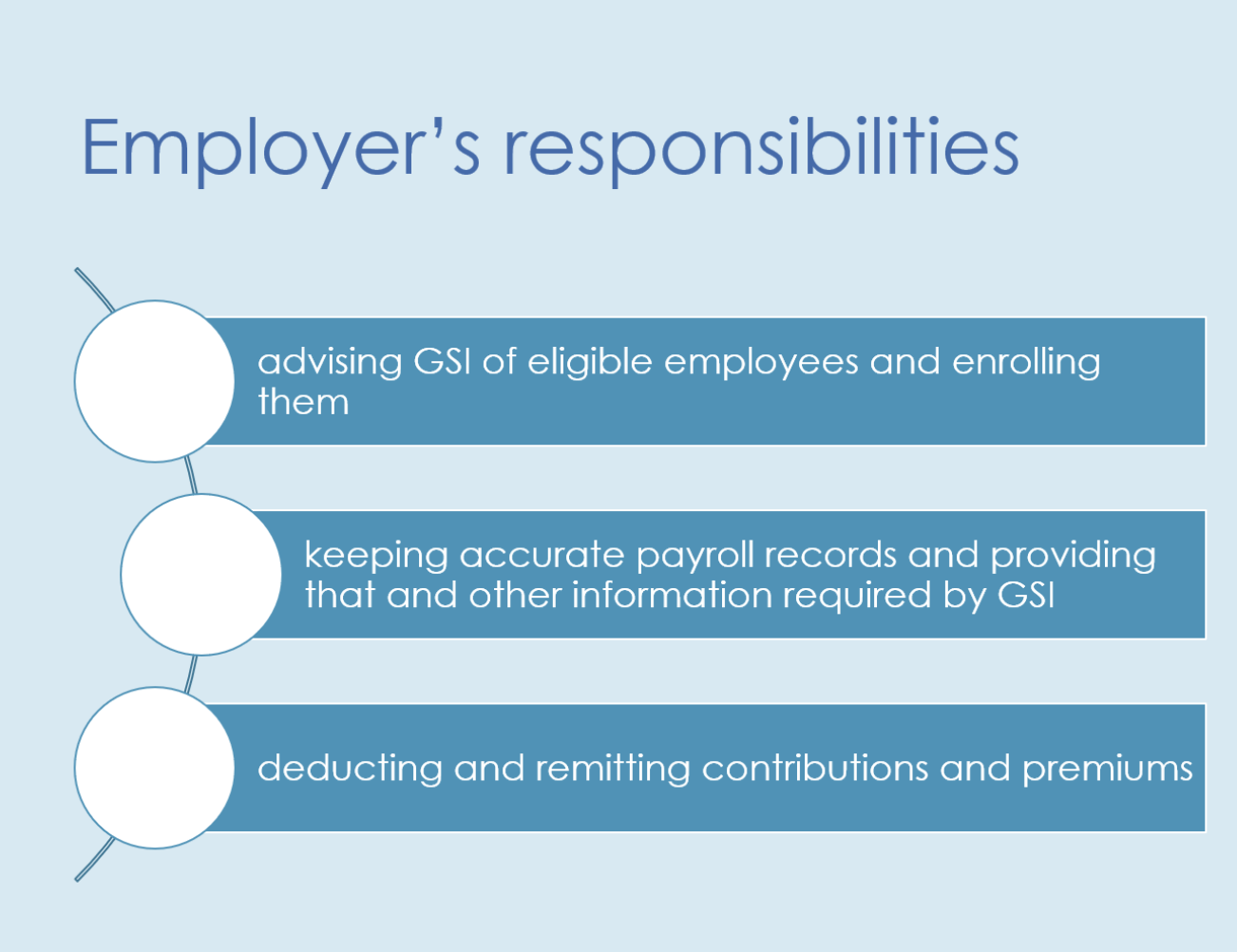

What Are the Roles of GSI and Employers?

All ELCIC congregations have signed a subscription and a participation agreement to lay out the roles and responsibilities in accordance with the ELCIC constitution. The charts below outline the basic expectations of each party.

Have a Question for GSI?

We welcome your questions and feedback!

Email admin@elcicgsi.ca

Information and resources can also be found on the GSI website.

Winnipeg Residents: 204-984-9181 | Toll Free: 1-877-352-4247