In this Issue

Using the Health Care Spending Account (HCSA)

Are you maxing out your HSCA? Here are some tips to make better use of it.

The flexibility of the HCSA accommodates individuals and families with a wide range of medical needs.

Those who need extra funds for prescriptions can use it for that. But HCSA can be spent on many other things. The full listing is available on the Canada Revenue Agency (CRA) website, but in general, anything covered by your Group Benefits module or your provincial health plan can also be paid for with HCSA. The amounts available in those pots of money often do not cover the full cost.

Here are some things you can do with your HCSA benefit:

Get Prescription Sunglasses

Many people exceed their dental and vision allowance in their Group Benefits Module each year. These treatments are essential but expensive. But did you know that if you used the regular Plan to buy glasses (and it covered the whole cost), the HCSA can be used for prescription sunglasses or contact lenses, for orthodontics, or for other dental treatments that are only partially covered?

essential but expensive. But did you know that if you used the regular Plan to buy glasses (and it covered the whole cost), the HCSA can be used for prescription sunglasses or contact lenses, for orthodontics, or for other dental treatments that are only partially covered?

Cover Your Copays

The ELCIC plan has a copay for things like dental exams, prescription drugs, and professional services. You can use your HCSA to cover the cost of the copay.

Visit the Professionals

Professional services such as acupuncture, chiropractor, podiatrist, and naturopath generally cost close to $100 per visit.

While the amount available for each of these practitioners under the GSI plan is higher than in many other plans, it still doesn’t get you many visits per year. HCSA can pay for extra visits.

Upgrade Your Hospital Room

Hospital coverage is not included in any of the Group Benefits Modules, but fees for a semi-private or private room can be covered by the HCSA.

Hospital coverage is not included in any of the Group Benefits Modules, but fees for a semi-private or private room can be covered by the HCSA.

Dispense with the Dispensing Fee

Your pharmacy may charge a higher dispensing fee than the “Reasonable & Customary” amount Manulife allows. The excess can be paid through HCSA.

Recover through Physio

If your athletic lifestyle has saved you from requiring expensive prescriptions, it may also position you to benefit from  massages, physiotherapists, and chiropractors. Even the $500 that Teal Plan members are allocated for each of these practitioners does not go very far if you’re experiencing musculoskeletal issues. Use the HCSA to access more treatments.

massages, physiotherapists, and chiropractors. Even the $500 that Teal Plan members are allocated for each of these practitioners does not go very far if you’re experiencing musculoskeletal issues. Use the HCSA to access more treatments.

Add Extra Sessions with Your Counsellor

The ELCIC plan offers a generous mental health benefit, but some Plan Members are using all of it before year-end. HCSA can help make up the difference.

Share with Your Family

You can use your HCSA to cover any of the above expenses for yourself, or you can use it for your spouse and dependent family members who are covered under your plan.

Manulife reports that most of their clients see Plan Members spending around 80% of the money set aside for Spending Accounts. With careful planning and time taken for self-care, most ELCIC Plan Members should be able to improve their quality of life by using their full HCSA.

What Was the Uptake of the LSA?

In 2023, the two-year pilot project of GSI’s Lifestyle Spending Account (LSA) came to an end. [2022 claims were able to be submitted and processed for the first months of 2023.] Here is some additional information that underpinned the decision to roll those funds into Plan Members’ HCSA.

What Did the LSA Cover?

Briefly, this was a benefit that could be used for a broad range of wellness-related activities: gym memberships, sports equipment, pet care, etc. The intent for the LSA was to provide another option for members to use their Benefits plan, but few people used it.

What Were Its Challenges?

A significant disadvantage to Lifestyle Spending Accounts — in general, not just the ELCIC one — is that they are a taxable benefit. That means the CRA requires any amount you spend from it to be added to your salary and housing for income tax purposes, and you then pay tax on it. This rule applies even if the expense you were applying it to would normally be non-taxable (i.e., anything covered under the regular Plan).

benefit. That means the CRA requires any amount you spend from it to be added to your salary and housing for income tax purposes, and you then pay tax on it. This rule applies even if the expense you were applying it to would normally be non-taxable (i.e., anything covered under the regular Plan).

Because it was a taxable benefit, Plan Members whose salaries were below YMPE (Yearly Maximum Pensionable Earnings) also paid CPP and EI on it. These costs only applied to amounts Plan Members used, so it was not a set amount per Member. It was challenging for Treasurers to record it and make the necessary calculations correctly.

Funds allocated to the regular Plan and for HCSA are not taxable income. Now that the full spending account is a HCSA, the extra costs of taxes, CPP, and EI do not apply.

Will Losing the LSA Impose a Financial Hardship on Plan Members?

There is no loss in available funds to Plan Members. The monies that had been allocated to LSA were redistributed to the HCSA.

Most people will come out further ahead financially now that the entire Spending Account amount is not taxable. The money that would have gone to taxes instead becomes available to them for other expenses (including the wellness items that had been available under LSA) rather than going to the government.

Can We Please See the Numbers?

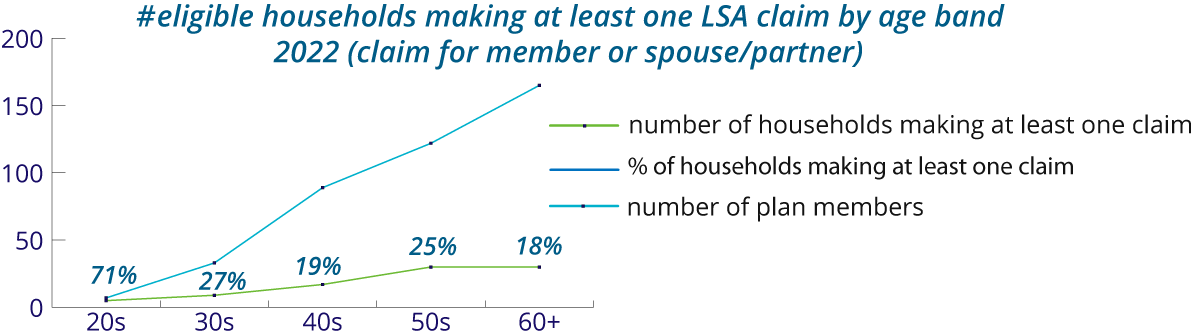

Sure! The charts below show the LSA’s usage during the two years GSI trialled it.

LSA Claims in 2022 by Age Bracket

| Age of Claimant | # of Plan Members | # Households Making at Least One Claim | % of Households Making at Least One Claim |

|---|---|---|---|

| 20s | 7 | 5 | 71% |

| 30s | 33 | 9 | 27% |

| 40s | 89 | 17 | 19% |

| 50s | 122 | 30 | 25% |

| 60s | 165 | 30 | 18% |

| 416 | 91 | 22% |

| Age of Claimant | # of Eligible Households with Children | Number of Households Making at Least One Claim | % of Households Making at Least One Claim for a Child |

|---|---|---|---|

| >25 | 150 | 17 | 11% |

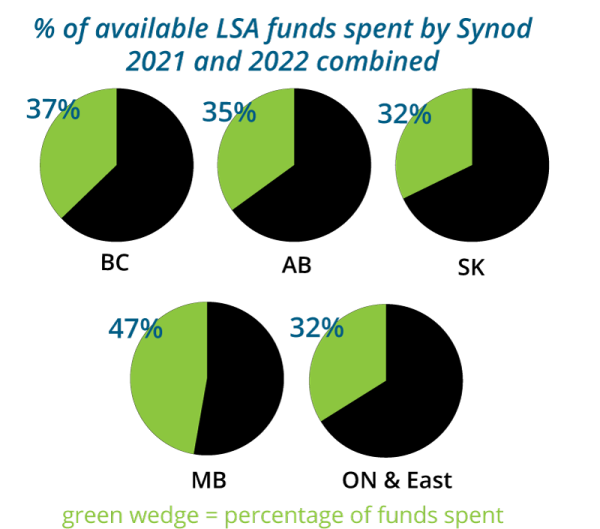

LSA Claims in 2021 and 2022 by Province

LSA Claims for 2021 & 2022 Combined

| Province | % of Available Funds Spent |

|---|---|

| BC | 37 |

| AB | 35 |

| SK | 32 |

| MB | 47 |

| ON & East | 32 |

As these charts demonstrate, the only demographic that was making good use of the LSA was the 20-29 age group, which had seven Plan Members in 2022.

Report on the 2023 DOTAC Conference

What is DOTAC you might ask? DOTAC stands for Diakonia of the Americas and Caribbean. It is an ecumenical group of Christian diaconal communities in North America, the Caribbean, Central America, & South America. Twelve different diaconal communities from different Christian faith denominations are represented.

DOTAC is a member community of World DIAKONIA Federation, which furthers the understanding of the diaconate, provides a network of mutual relationships crossing church traditions and cultural boundaries, and provides a forum for discussion of diaconal issues including social justice and reconciliation.

The 2023 Conference

The last DOTAC conference was in August of 2019, in Vancouver. This past August, the conference was in Minneapolis, and the ELCIC was represented by six deacons. It was a wonderful time of learning, worship, and just being deacons together!

Deacon Michelle Collins, the Assistant to the Bishop of the MNO Synod, had this to share when reflecting on this year’s conference:

Gathering in the same room in Minneapolis with deacons, deaconesses, and home missioners from various denominations throughout North America, the Caribbean, and Brazil was a beautiful reflection of unity in diversity.

Each denomination understands and organizes itself, its ministries and its leaders differently, but the unifying language of diakonia and a commitment to be the physical presence of God’s love in the midst of the world’s pain draws us together.

Spending a few days singing, praying, learning, discussing, and laughing together reminded me of the incredible gift of the body of Christ. Prioritizing time for learning, fellowship and formation with other deacons is essential as I seek to stay attentive to how I am called to live out my baptismal identity.

Visit to the George Floyd Memorial

One of the most meaningful experiences for me while I was there was to visit the George Floyd memorial site. (See photos below.) Our group was hosted by local interpreters, men who lived in that community and who have been involved in it for their whole lives. It was amazing to learn from them about the impacts of that event, which impacted all of us, no matter where we lived at the time. We also appreciated hearing from them how the community has moved forward.

That visit was a reminder of my sense of call to care for all neighbours, across the globe. It was a sacred morning, the memory of which will be woven into my sense of call to diakonia — to serve God in love and service to others.

This conference is obviously only open to deacons, but I wanted to take this opportunity to lift it up to our whole GSI community. We are all called into service for the sake of telling the Good news of Jesus’ love for all of creation. Hopefully this article and these pictures are a reminder to all of us of that.

More information about using your Continuing Education Plan (CEP) funds to attend church-related conferences such as the one Gretchen attended can be found on the CEP page of the GSI website.

Change in Travel Coverage Provider

Manulife is partnering with a new provider for out-of-country and emergency travel assistance. When the previous provider decided to withdraw from the market, Manulife explored the possible providers to determine which  was the best fit and the most suitable to meet the needs of plan members.

was the best fit and the most suitable to meet the needs of plan members.

- The new provider — Global Excel Management (GEM) — has expertise that circles the globe, but its roots are Canadian. The company was founded (and remains) in Sherbrooke, QC in 1984. GEM is one of the largest independent providers servicing the Canadian out-of-country/emergency travel market in assistance, cost containment, case management and claims adjudication.

- Beginning September 1, 2023, GEM is handling calls and supporting you, the member, when you have questions before you leave and when you are experiencing an out-of-country medical emergency.

The transition to GEM will be smooth and seamless. There aren’t any changes to the coverage. The current phone numbers that you use will continue to work as expected. Calls will be answered by GEM representatives.

Ontario Biosimilar Initiative

What is this initiative?

In July, the Government of Ontario government announced a biosimilar initiative to expand the use of biosimilar drugs (in place of biologics) for specific conditions. Manulife has aligned their coverage to the Ontario plan, for those members who have provincial plan coverage.

Who is affected?

Members who reside in Ontario, who are age 65 and older, and who are taking certain biologic drugs (listed in the accordions below) will need to switch to a biosimilar drug to continue to receive coverage through the Ontario Drug Benefit (ODB) and their GSI plan.

Example: A member age 65 and over, who is taking Humira for one of the listed conditions, must change their prescription to a biosimilar drug before December 29, 2023, to receive ODB coverage

Biologic drugs affected by the Ontario Biosimilar Initiative

*Glatiramer is a non-biologic complex drug; however the ODB is including this drug in their biosimilar program.

What about those living in other provinces?

Manulife previously announced alignment with Biosimilar Initiatives in several other provinces: BC (2019), Alberta (2021), Québec (2021), and Saskatchewan (2023). Note that the list of affected drugs is not identical across the provinces.

Interested in learning more about Biosimilars? The Government of Canada explains them pretty well in this Factsheet.

Benefits Card FAQ from Manulife

Wondering whether you can use your Benefits Card in another province? How to get a digital Benefits card? What to do if your Benefits Card is stolen?

Wondering whether you can use your Benefits Card in another province? How to get a digital Benefits card? What to do if your Benefits Card is stolen?

Manulife has prepared an excellent Frequently Asked Questions about your Benefits Card. You can read their answers to these and many other question in their FAQ here.

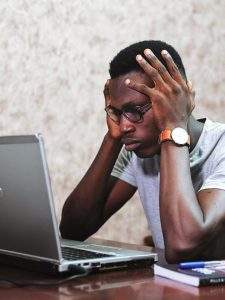

Upcoming Webinar: Stress and Burnout

Ask an Expert Question / Concern: “I’m so tired all the time, I feel like I don’t have time or energy to give to  my friends and family. What can I do”

my friends and family. What can I do”

Date: Wednesday, September 13 (tomorrow!)

Time: 12:00 – 12:30 PM ET

Description: September is a busy month for many as the summer vacations come to an end and work ramps up full force. Join CloudMD this month to hear about stress management techniques and how to prevent burnout.

Have a Question for GSI?

We welcome your questions and feedback!

Information and resources can also be found on the GSI website.

GSI Website: elcicgsi.ca

Winnipeg Residents: 204-984-9181

Toll Free: 1-877-352-4247