Deadline to Change Benefits Modules is THIS WEEK

You still have a couple more days to reflect on your benefits needs and select your benefits module option that will start on January 1st. Members can move to an adjacent module (e.g., from green to teal) by filling in a Group Benefits Enrollment form and submitting it to the GSI office by Thursday, December 14, 2023, not the 18th as previously indicated.

Additional Info about Changing Modules

Some coverage amounts, such as glasses/contacts, are available every 24 months months (i.e., the funds become available again 24 months after use). Note that, unless stated, this does not mean every two calendar years; the clock starts only once you make a purchase that results in a claim. If you change modules, it can be tricky to calculate how much you have available.

| Glasses/Contacts Maximums each 24 months | Blue | Green | Teal |

|---|---|---|---|

| $0 | $250 | $400 |

Let’s look at a couple of examples that show what happens when a Plan Member changes modules and buys contact lenses.

Example 1: No Change in Modules

| Jan 1 2023 | enrolled in teal | 400 |

| July 15 2023 | buy contacts for $222; claim paid (A) | (222) |

| balance remaining | 178 | |

| Aug 12 2024 | buy contacts for $222; claim paid (B) | (178) |

| balance remaining | 0 | |

| July 16 2025 | 24 months later amount (A) is replenished | 222 |

| balance available | 222 | |

| Aug 13 2026 | 24 months later amount (B) is replenished | 178 |

| balance available | 400 |

Example 2: Switch from Teal to Green

| Jan 1, 2023 | enrolled in teal | 400 |

| July 15, 2023 | buy contacts; claim paid (A) | (222) |

| balance remaining | 178 | |

| Jan 1 2024 | switch to green | 250 |

| reverse teal | (400) | |

| adjusted balance remaining | 28 | |

| July 16 2025 | 24 months after (A), amount is replenished | 222 |

| new balance available | 250 |

Example 3: Switch from Green to Teal

| Jan 1, 2023 | enrolled in green | 250 |

| July 15, 2023 | buy contacts; claim paid (A) | (222) |

| balance remaining | 28 | |

| Jan 1, 2024 | switch to teal | 400 |

| reverse green | (250) | |

| adjusted balance remaining | 178 | |

| Aug 12, 2024 | buy contacts for $222; claim partially paid for (B) | (178) |

| July 16, 2025 | 24 months later amount (A) is replenished | 222 |

| Aug 13, 2026 | 24 months later amount (B) is replenished | 178 |

| balance August 13, 2026 | 400 |

Application for Advanced Study Grants

Every January, I look forward to receiving applications from CEP (Continuing Education Plan) members who have plans to either start an advanced education program or to continue in their studies, as they apply for the Advanced Study Grants.

Every January, I look forward to receiving applications from CEP (Continuing Education Plan) members who have plans to either start an advanced education program or to continue in their studies, as they apply for the Advanced Study Grants.

These applications are reviewed by the Program Committee for Leadership for Ministry (PCLM), which consists of a rep from each synod, a rep from each of our ELCIC Seminaries, and myself as National Office staff. It’s exciting to see what type of studies our leaders are engaged in!

Thinking of engaging in deeper learning through a program in advanced learning? Make sure to apply for the Advance Study Grant! The deadline is January 15, 2024. Find the application form here.

Vaccinations and the ELCIC Group Benefits Plan

Many vaccinations are covered under provincial health plans. The flu shot, for example, has been available to most Canadians for free for some time now.

Others are not. Luckily, some vaccinations that aren’t covered through your provincial health insurance are covered by the ELCIC Group Benefits Plan. If you thinking about getting a vaccine that is not free in your province, please call the Manulife customer service line at 1-800-268-6195 to confirm whether the vaccine you are considering is eligible for coverage.

Vaccines that are not included in the list under prescription drugs but that are prescribed by a physician or pharmacist and dispensed by a pharmacist are eligible to be paid from your Health Care Spending Account (HCSA) — as is the co-insurance payment that accompanies a prescriptions claim.

Here are some examples of vaccines that are covered under the ELCIC Group Benefits Plan:

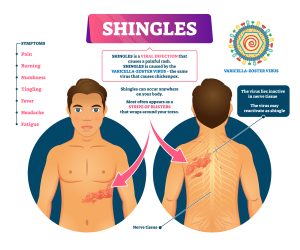

Shingrix

Health Canada approved Shingrix in Canada in 2017. Delivered in two doses, two to six months apart, Shingrix can prevent or significantly reduce the incidence of herpes zoster (rash with blisters) and post-herpetic neuralgia (prolonged and debilitating pain that can last for months after the rash is gone) if a person contracts shingles. It is still possible for a vaccinated person to get shingles, but the duration and severity of the symptoms are usually much less if vaccinated.

Health Canada approved Shingrix in Canada in 2017. Delivered in two doses, two to six months apart, Shingrix can prevent or significantly reduce the incidence of herpes zoster (rash with blisters) and post-herpetic neuralgia (prolonged and debilitating pain that can last for months after the rash is gone) if a person contracts shingles. It is still possible for a vaccinated person to get shingles, but the duration and severity of the symptoms are usually much less if vaccinated.

In most provinces, Shingrix requires a prescription, and normally only those 50 and older are eligible to receive it.

Shingles is relatively common in Canada, especially for those who have had chicken pox, so if you’re eligible, it’s a good idea to consider getting this vaccine.

Twinrix

This vaccine is used to prevent hepatitis A and B. If you are traveling this winter to popular warm destinations, you may want to consider getting this vaccine.

This vaccine is used to prevent hepatitis A and B. If you are traveling this winter to popular warm destinations, you may want to consider getting this vaccine.

Like Shingrix, Twinrix is administered in multiple doses for best protection, so ideally you would start the first one well in advance of your trip. Normally Twinrix requires three doses within six months. Unlike Shingrix, even children can receive Twinrix. (As always, those who are considering getting this vaccination should consult with their physician to ensure they are a good candidate for it.)

Other Vaccinations for Travellers

Most of the vaccines the Government of Canada recommends for travellers will be covered under your plan — in most cases as a prescription drug. (As noted, some may have to come out of your HCSA.)

This page presents the current recommended travel vaccinations per country.

Please note that this information is not intended to be medical advice. Readers are advised to consult their family physician or other medical practitioner for further information and recommendations.

Continuing Ed for GSI Directors

High expectations are placed on GSI Directors (by regulators, Plan Members, congregations and especially themselves) to perform the role to which they were elected. In fact, one of the GSI’s policies clearly requires this: “The board Directors should have the necessary knowledge to effectively perform their duties.”

This knowledge should encompass both technical aspects and current industry developments. Directors bring knowledge with them from their careers and other life experiences. However, they also take advantage of opportunities to supplement and enhance that knowledge with professional development targeted specifically to the pension and benefits industry as it relates to GSI and the ELCIC.

Various associations related to pension and benefits regularly provide opportunities to engage in learning via conferences, breakfast sessions and webinars. The November Pension Newsletter, for example, featured an article the Board Treasurer, Ray Henrickson, wrote about a conference he attended.

Consultant-Guided Education

In addition, GSI asks their consultants to include educational content and current industry information when they deliver their annual presentations to the Board. This is a cost-effective way for Directors to gain knowledge and for the consultants to provide support as added value.

Our benefits provider is Manulife. GSI has engaged Mercer as our consultant to review the options included in the benefits package, the premiums we are charged by Manulife, upcoming changes in the industry, and other aspects.

At the most recent board meeting, Mercer Benefits Consultants gave a presentation that began as an orientation for the two new Directors and a refresher for the ongoing Board Directors. It then shifted focus to current industry trends and challenges. After the presentation, I had a chat with Cath Wilke, Benefits Committee Chair, for her thoughts. Her responses are in purple.

Interview with Cath about the Presentation

What do you think was most helpful for the new Directors in the orientation portion of the Mercer presentation?

An understanding of the purpose of providing a group plan is the foundation for making decisions. So for me and I’m sure for the new Directors, it was helpful to be reminded that the benefits plan provides financial protection for health events. The board’s role as the sponsor is to create a care package that provides support for the members.

Let’s start with the heart of the session; what was the most important thing that you learned?

It was helpful to step back and remember that the purpose of a group benefits plan is to provide financial protection against events that cause significant hardship or stress for Plan Members and their families. It is important that we think specifically of Plan Members and congregations as decisions are made. Our benefits package offerings are within the norms of plans other organizations provide to their members.

What were some key takeaways regarding a group benefits plan?

Providing a group benefits plan is expensive, and the costs will continue to increase annually. It was significant to note that the funds available for counselling to our members and their families are four-to-five times greater than what most companies offer their membership.

Was there anything in the orientation that may have been surprising even after serving on the board for six years already?

I was a little shocked to hear that the total group benefit insurer premium in 2021 was $48.9 billion. This just confirms to me that benefits is ‘big business,’ and while part of GSI’s role has to be to make the Plan relevant for our Plan Members, we must also look at cost containment. We have built relationships with people at Manulife and are now considered and consulted when new products or processes are introduced. This allows us to continue to be diligent in the review of the benefits program we offer.

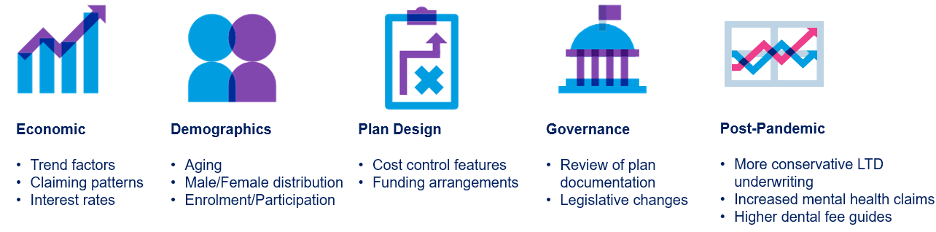

The presentation got somewhat technical in educating directors on the factors that influence the annual contract renewal and rate setting for the coming year. Can you share a bit of what sorts of things are considered?

Understanding industry jargon can be quite challenging, as the benefits industry has its own language. Mercer explained it using this graphic, which provides some insight into all the considerations that go into the determination of premiums, what is covered, etc.

Infographic © Mercer 2023

We, as Directors, must be able to trust the information our consultants bring to the table to ensure we are able to balance the benefits our members need with the costs of those benefits.

Thanks, Cath. I always appreciate hearing the takeaway Board Directors get from these sessions.

Webinar: Managing Family Stress

The holiday season, already!? Many may be preparing for a traditionally joyful period but also one that leads to increased levels of stress. This is especially the case for clergy and other church workers.

The holiday season, already!? Many may be preparing for a traditionally joyful period but also one that leads to increased levels of stress. This is especially the case for clergy and other church workers.

With all the hustle and bustle, you may feel like your emotional, mental, financial or time-related resources are stretched.

The question addressed in the webinar is:

“My family keeps stressing me out during the holidays. I want to make everyone happy but it seems impossible. How can I avoid the stress?”

The webinar will be tomorrow, Wednesday December 13, at 12:00 pm EST. If you miss it, you should be able to view the recording afterwards using the same registration link.

Have a Question for GSI?

We welcome your questions and feedback!

Information and resources can also be found on the GSI website.

GSI Website: elcicgsi.ca

Winnipeg Residents: 204-984-9181

Toll Free: 1-877-352-4247