Should I Be Getting Critical Illness Insurance?

Manulife offers two personal benefits that Plan Members can purchase individually if the choose to, in addition to the employer-paid benefits available with the Blue-Green-Teal Group Benefits Plan. One is term life insurance. The second, which we will be exploring in this article, is critical illness insurance. You can find out more about both of these benefits on the Manulife website.

A Benefits Canada Healthcare Survey found that only 25% of group plans have optional critical insurance. Your plan is one that does!

What is Critical Illness Insurance?

Critical illness insurance offers a lump sum payment should the person covered receive a diagnosis that appears on the set list. Its purpose is to reduce financial stress at a time when people are experiencing a lot of other stress.

The money can be used as needed:

to cover lost wages (especially for a partner or parent who takes time off work to care for the sick person)

to cover lost wages (especially for a partner or parent who takes time off work to care for the sick person)- to pay for expensive tests or treatments that are not covered by the government or your Group Benefits Plan

- to buy specialized equipment or do renovations to accommodate the diagnosed person

- to take a memorable family vacation before a person with terminal illness passes

- to hire a housekeeper, caregiver, or child care

- to pay off debt

Who Can Benefit from It?

This type of insurance is especially useful for those who would be left financially strapped should they or a family member be diagnosed with a covered condition. It’s less useful for those who would have access to alternative funds in this situation (e.g., from parents or from investments).

Manulife allows Plan Members to purchase critical illness insurance for a spouse or child even if the Plan Member does not wish to purchase it for themself. Learn more about who is eligible here (“who is personal critical illness insurance for” section).

What Diagnoses are Covered?

Each insurance company has a different list of diagnoses that are covered. Manulife’s list has 22 diagnoses for adults and an additional 7 diagnoses for childhood medical conditions. Those pages both have detailed explanations for what diagnoses exactly are covered. For example, with Manulife, only some cancer diagnoses are eligible for coverage.

Can Covered Persons Access Anything Else, Besides the Lump Sum Payment?

Yes! With Manulife’s critical illness insurance, a person who receives an eligible diagnosis is eligible for Medical Second Opinion (MSO). More than 100 diagnoses are eligible for MSO; the full list appears here.

Yes! With Manulife’s critical illness insurance, a person who receives an eligible diagnosis is eligible for Medical Second Opinion (MSO). More than 100 diagnoses are eligible for MSO; the full list appears here.

This allows them to access top specialists for consultation about their diagnosis and treatment plan. Mental health MSOs are also available for conditions such as major depression and bipolar disorder.

How Much Does It Cost?

The cost will vary according to factors such as the amount of coverage, person’s age, smoker or non-smoker, etc. On Manulife’s website, they suggest that “typically, policies purchased from a group plan can be more affordable than what you can find on your own.”

The cost will vary according to factors such as the amount of coverage, person’s age, smoker or non-smoker, etc. On Manulife’s website, they suggest that “typically, policies purchased from a group plan can be more affordable than what you can find on your own.”

Manulife’s booklet on the GSI website notes that in most cases, Plan Members and their spouse can purchase up to $25,000 insurance without a medical exam — though disclosure of existing medical conditions is required. Member and spousal coverage is available in $5000 increments up to a maximum of $150,000.

What Else Do I Need to Know?

Manulife’s website (“Why is it worth it?” section) notes that since this is personal insurance that you own, it travels with you if you change jobs.

If you’re considering purchasing critical illness insurance for you or your family members, it’s important to read very carefully the list of covered diagnoses, the terms of the insurance (e.g., how long is the waiting period after purchase before the insurance kicks in?), and the cost (will premiums increase and when?). It may be that for your personal circumstances, critical illness insurance from a different insurance company would work better.

You can apply for Manulife’s critical illness insurance using the Apply Now button at the bottom of this page on the Manulife website.

Conclusion

Since we do not have the ability to see into the future, it’s always hard to know whether or not to purchase additional insurance. If you or your loved ones are going to be diagnosed with one of the covered medication conditions, critical illness insurance certainly is worth it. Without the foreknowledge, all we can do is assess our own situation (likelihood of being diagnosed, capacity to weather lost income, ability to manage premium payments) and pray that we’ve made the right decision.

Since we do not have the ability to see into the future, it’s always hard to know whether or not to purchase additional insurance. If you or your loved ones are going to be diagnosed with one of the covered medication conditions, critical illness insurance certainly is worth it. Without the foreknowledge, all we can do is assess our own situation (likelihood of being diagnosed, capacity to weather lost income, ability to manage premium payments) and pray that we’ve made the right decision.

CPBI Conference 2024

An Interview with Board Director Sabrina Buffie

The Canadian Pension & Benefits Institute (CPBI) Conference (Western Region) was held in Banff in early May. This is typically a great learning event for GSI directors to gain insights into the industry and gather information to help in decision making for the ELCIC group plans.

I sat down with Sabrina Buffie after the conference to hear her thoughts on the event.

Lisa: As a new GSI Director, can you comment on the value of professional development and how it informs your decision making for the ELCIC group plans?

Sabrina: Although Board Directors bring existing knowledge to the table, both the group benefits and pension industries continue to evolve. Attending diverse training programs and workshops allows me to stay current and exposes me to more real-world challenges and examples. In-person sessions also provide the opportunity to connect with other participants and hear what they’re doing for their Plans or ideas they’ve tried.

This all provides a solid background to better solve problems and make decisions for the ELCIC group pension and benefits plans.

Lisa: Was there an overall key takeaway that you took from the conference?

Sabrina: The key takeaway for me was that there is a large group of dedicated benefits professionals in Canada whose purpose is to improve the lives of Plan Members through innovation and unique offerings, while being aware of the challenge of rising plan costs.

Lisa: Can you tell us about the most interesting session(s) you attended and what you learned there?

Sabrina: A few of the sessions that stood out to me were:

AI and the Art of Racing: Steering the Future of Financial Services

Dr. Preet Banerjee, a wealth management researcher, started his presentation by relating some of the fears around Artificial Intelligence (AI) to his experience with race cars. The improvements to modern race cars (e.g., not having to use three pedals with two feet!) have made driving better, even though they were doubted at first.

Dr. Preet Banerjee, a wealth management researcher, started his presentation by relating some of the fears around Artificial Intelligence (AI) to his experience with race cars. The improvements to modern race cars (e.g., not having to use three pedals with two feet!) have made driving better, even though they were doubted at first.

He expanded on other areas of research such as willpower. Dr. Banerjee’s research finds that willpower is a depletable resource; when a person is facing a difficult decision, the timing or order of events during the decision making process matters. He also shared that in the absence of good information, our brains latch on to any available information, called an anchor. For example, when looking at your credit card statement, he suggests focusing on the balance owing instead of having your anchor be the monthly minimum payment.

A Fireside Chat about the Future of Defined Contribution Plans

This session noted that much has changed over the past 20 years for savings plans in Canada, such as the addition of target date funds and Tax-Free Savings Accounts. Since lifetime employment with one employer is no longer common, members would benefit if savings programs were to include other options like TFSAs and RRSPs— rather than just focusing on a pension plan.

A trend seen in other countries is public pension plans’ starting to invite smaller employers to join. These are called Multi-Employer Pension Plans, and they offer administration efficiencies, economies of scale for member rates, and a way for members to leave their funds in a plan if they do not remain with the same employer until retirement.

Group Insurance and Productivity: The Ups and Downs of Long-Term Disability

This session piqued my interest in its findings that Long-Term Disability (LTD) claims are down. As the session continued, the presenter expanded on why this would be. He presented a stat that 37% of mortgage defaults are due to disability. This staggering statistic highlighted that LTD claims may have temporarily decreased due to people not being able to afford to go on a reduced income — not because there were fewer illnesses.

This session piqued my interest in its findings that Long-Term Disability (LTD) claims are down. As the session continued, the presenter expanded on why this would be. He presented a stat that 37% of mortgage defaults are due to disability. This staggering statistic highlighted that LTD claims may have temporarily decreased due to people not being able to afford to go on a reduced income — not because there were fewer illnesses.

Plan sponsors can better prepare members by promoting their group savings plans as a way to maintain an emergency fund for times of illness.

Lisa: Thanks, Sabrina, for sharing this with the Plan Members.

Mental Health & Counselling Services

Here’s some information Manulife has provided about the mental health services offered under your benefits plan. This service is there to help you find a counsellor, but the cost is charged as a claim to your professional services benefit, with the amount dependent on your module. You will pay the coinsurance out of pocket. (This is different from the MFAP, where you don’t pay anything, but the MFAP is short-term crisis focused).

We can help you on your path to mental wellness

Looking for support with managing stress or anxiety, adapting to a change in your life, or dealing with workplace or relationship challenges?

Getting mental health care just got easier!

You and your eligible family members now have access to mental health & counselling services through your extended health care (EHC) benefit under your group benefits plan. It’s a voluntary program – and fully confidential.

Benefit from:

- 1-on-1 personalized live care support by chat or phone to help you find the appropriate

mental health provider and book or reschedule appointments - short wait times to speak to a counsellor – typically within 5-7 days

- limited out-of-pocket expenses – most providers can bill Manulife directly, so you only pay if you go

over your coverage - and more

Check out the new experience on the Manulife Mobile app or plan member site. And get more health from your benefits.

Helpful Suggestions from Barb

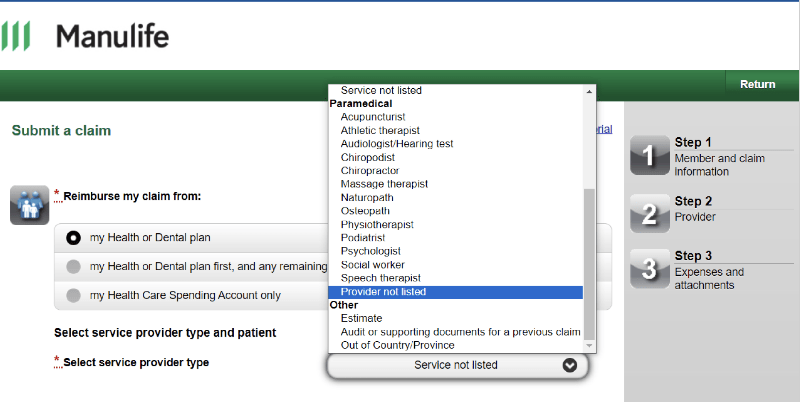

July Claims Tip: Provider Not Listed

Professional services are a well used benefit, as indicated by the annual report from Manulife for the ELCIC Group Benefits Plan. The report showed there were 492 claimants (these could be a Plan Member, their spouse or a dependent child); as there were just over 400 active Plan Members in 2023, this averages to more than one claimant per household. Together, these claimants made 5,013 claims.

Some members have reported challenges with making a claim for professional services. The screen shot (below) shows the list to select the type of professional services provider accessed, but it is not complete.

Specifically, the following providers are covered under the ELCIC Group Benefits Plan but don’t appear in the list:

Specifically, the following providers are covered under the ELCIC Group Benefits Plan but don’t appear in the list:

- Dietitian

- Kinesiologist

- Clinical Therapist

- Marriage and Family Therapist

- Master in Social Work

- Registered Social Worker

- Registered Psychotherapist

If you are making a claim for any of these, please select “provider not listed” and continue with the prompts.

July Webinar: Managing Chronic Illness/Pain

Ask an Expert Question/Concern:

“My condition makes it really hard to do the things that I used to do. I find myself staying in more and losing touch with friends, and it’s really getting to me. Is there anything I can do?”

Date: Wednesday, July 10, 12:00 – 12:30 PM ET

Chronic pain or chronic illnesses – conditions that are long-lasting or may come and go over the course of a lifetime – can touch every aspect of a person’s life. They can impact your day-to-day, your ability to work, your financial situation, your relationships, and of course, your physical and mental health.

Chronic pain or chronic illnesses – conditions that are long-lasting or may come and go over the course of a lifetime – can touch every aspect of a person’s life. They can impact your day-to-day, your ability to work, your financial situation, your relationships, and of course, your physical and mental health.

Join our expert (Khush Amaria, PhD, C.Psych) this month to learn skills and strategies for managing these impacts and living well with a chronic condition.

As always, the recording will be available afterwards at the same link.

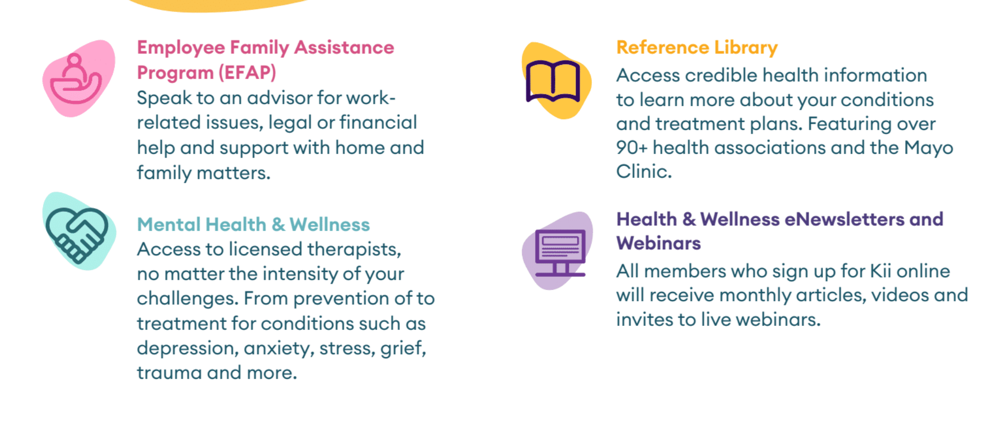

All About the Offerings from Kii

We wrote about HumanaCare’s rebranding to Kii in the June Benefits Newsletter. This rebranding has now taken effect.

Welcome to Kii!

ELCIC Group Services Inc., as your plan sponsor, has invested in Kii, a health & wellness program, to provide you and your dependents with the support you need, when you need it.

Kii is here to empower you throughout your lifelong journey to healthier living.

As a member of the ELCIC Group Benefits Plan, you and your dependents have access to:

Work Life Support: Your Member and Family Assistance Plan (MFAP)

- Short-term therapy/counselling

- Financial, legal, family and stress-related services

- Health system navigation including caregiving and care support

MindBeacon’s Guided iCBT (internet Cognitive Behavioural Therapy) through Kii

- Evidence-based program to treat depression, anxiety, sleep trouble, stress and much more.

- Access up to 12 weeks of support with a dedicated licensed therapist.

- Your therapist guides you through a CBT program of readings and exercises to help you improve your resilience and face life’s challenges.

- Therapy available on your own time, whenever it’s convenient

- Confidential and secure digital experience

Health Resource Library, Your Source for Reliable Trusted Health Information

- Search health topics, concerns, and common procedures

- Featuring trusted resources from over 100+ health associations & the Mayo Clinic

How to Access Kii

- The first step is joining Kii, which only takes a minute.

- Activate your free account by visiting www.kiihealth.ca on any web browser (computer, tablet or smartphone) and register for an account using access code: ELC0724. Complete your profile and create a password.

- Click the link in the email confirmation, and you’re done!

OR call 1-866-814-0018, 24 hours a day, 7 days a week.

Here is a brochure with more information about the available services and a membership card that you can print out and add to your wallet.

And here’s a nice graphic from the brochure that summarizes Kii’s offerings.

New Benefits Reminders

Access to Personalized Medicine and Therapist Assisted Internet Cognitive Behavioural Therapy (TAiCBT) began on July 1. For more info, visit these pages on the GSI website:

We Welcome Your Questions & Feedback!

Please write to us: admin@elcicgsi.ca

Or call toll free: 1-877-352-4247 (in Winnipeg 204-984-9181)

Information and resources can also be found on the GSI website