How Co-insurance Works

for Professional Services Claims

In the ELCIC Benefits Plan, as in many other benefits plans, some medical expenses are completely covered by the Plan, and other expenses are covered only at a certain percentage. The amount not covered — that is, the amount paid by the Plan Member — is called co-insurance. Co-insurance means that the member shares a portion of the cost of each claim made.

What Types of Expenses Have a Co-insurance Payment?

Members are responsible to make a partial payment referred to as a “co-insurance payment,” when making claims for medical expenses in the first column of the table below:

| Has co-insurance | Does not have co-insurance |

|---|---|

| prescription drugs professional services (a.k.a. paramedical services) insulin pumps dental services | vision travel medical services medical supplies (excluding insulin pumps) |

What Percentage is the Co-insurance Payment for Professional Services?

The amount of co-insurance required is expressed as a percentage of the eligible claim amount. This percentage varies according on the Module that the member is enrolled in.

| Module | Blue | Green | Teal |

|---|---|---|---|

| Manulife Pays | 60% | 70% | 80% |

| Member Pays | 40% | 30% | 20% |

Please see the Benefits Virtual Booklet for more information about co-insurance percentage for other medical expenses mentioned.

Why Do These Benefits Have Co-insurance?

While it would be wonderful if every medical expense could be covered at 100% with no maximum, such a plan would cost much more than employers in the ELCIC would be able to afford. The plan design strives to offer benefits that are useful to Plan Members and helpful for their physical and mental health while keeping costs to a level that congregations can manage. As the greatest portion of the visit cost is paid by the employer, co-insurance helps with the sustainability of the Plan for the future.

Also, without the co-insurance, plan members would reach the maximum much sooner, resulting in fewer possible visits to the professional service provider. The intent of the Plan is to support the members’ and their families’ long-term wellness and more chronic or severe illness rather than a one-time treatment, where the cost is lower and easier to meet within their monthly budget.

As the cost of prescription drugs and professional services rise, many benefits plans that didn’t already have one are introducing co-insurance or deductibles, in the interest of plan sustainability. This is not a feature unique to the ELCIC plan.

Claims Payment Examples

Example #1: Green Plan Member to Chiropractor

Here is an example of a Plan Member, enrolled in the Green Module, who is visiting a chiropractor.

Assuming that each visit costs $63.00 (based on a 2023 Manitoba claim), the plan will cover 70% ($44.10) per visit, until the maximum ($400 for chiropractor services) is reached. The member must pay 30% ($18.90) per visit in this example. The plan coverage under the Green Module will support nine visits plus a portion of the tenth visit before reaching the maximum.

| Visit | Fee per visit | Plan covers 70% | Member covers 30% |

|---|---|---|---|

| 1 - 9 | $63 | $44.10 | $18.90 |

| 10 | $63 | $3.10 | $59.90 |

| Total | $630 | $400 | $230 |

Example #2: Teal Plan Member to Psychologist

In this next example, a Plan Member enrolled in the Teal Module visits a psychologist.

The cost per visit is $178.50 (based on a 2023 claim in BC). A plan member can have a counselling session each week for 35 weeks before reaching the maximum, with a co-insurance payment of $35.70 per visit.

| Visit | Fee per visit | Plan covers 80% | Member covers 20% |

|---|---|---|---|

| 1 - 35 | $178.50 | $142.80 | $35.70 |

| Total | $6,247.50 | $4,998.00 | $1,249.50 |

Can I Use My HealthCare Spending Account (HCSA) to Pay my Co-Insurance?

You sure can! As was noted in the September Benefits News, the HCSA can be used to cover not only the co-insurance associated with Professional Services, but also the co-insurance for dental exams and prescription drugs.

In the examples above, the HCSA could also be used to pay for additional visits beyond the maximum covered. So, if the person in Example #1 required twelve visits to the chiropractor rather than ten, they could pay for visits 11 and 12 through HCSA.

If your spouse has a benefits plan, you may also be able to use coordination of benefits to have their plan cover your co-insurance.

Still Have Questions?

If anything about how co-insurance work or how to use the HCSA to pay them is unclear to you, please contact the GSI office. (Contact information is at the bottom of this newsletter.) The office staff are happy to clear up confusion and help you get the most out of your Benefits Plan.

Accessing Professional Services on Our Plan

The ELCIC Benefits Plan offers coverage for a wide range of professional services. As noted above, a co-insurance payment is required to access them. However, unlike in some other plans, Plan Members do not need a doctor’s prescription in order to submit claims for these services, and there’s no deductible.

Could You Explain Maximums?

The maximums listed for the Professional Services are for each covered person. For example, for the chiropractor visits in Example #1 above, the Green Module Family Plan Member gets $400, their spouse gets $400, and each child would have a separate $400.

The maximums also apply per service covered. So, for example, the spouse of a Green Module Family Plan Member could spend $400 on Acupuncture, $400 on Massage, $400 on Chiropractor AND $400 on a Dietician.

The HCSA is shared among all covered family members. So, in the case of a Green Module Family Plan, the entire family would have $1,100 – not each person.

What Types of Services are Covered?

This section describes the services that are currently covered under our Plan. These may change in the future; before accessing a particular service, it’s always a good idea to check the Virtual Benefits Booklet for up-to-date information. We also recommend checking to ensure that your service provider has not been delisted.

Counsellor

Counselling provides support for those who are experiencing many mental health and relationship challenges. Manulife coverage currently includes the services of these practitioners:

- Psychologist

- Clinical Therapist

- Marriage and Family Therapist (MFT)

- Counsellor having a Masters in Social Work (MSW)

- Registered Social Worker (RSW)

- Registered Psychotherapist

| Counsellor | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Maximum for these therapists combined | $3,000 | $4,000 | $5,000 |

In 2022, Counselling Services accounted for the greatest amount of dollars spent under the Professional Services category in the ELCIC Plan, at 43% of the claim costs.

Massage Therapist

Among the many wellness benefits of massage therapy are decreased stress and anxiety, pain management, better mobility, improved sleep, and increased immune response. To be eligible for coverage, your massage must be performed by a licensed practitioner who is registered in the province in which they’re practicing.

| Massage Therapist | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Annual Maximum | $300 | $400 | $500 |

Massage therapy represented the greatest number of claims made by Plan Members and dependents, and 16% of the claims costs in the Professional Services category in 2022.

Chiropractor

The Canadian Chiropractic Association describes chiropractic care as “a hands-on, non-invasive, and drug-free practice that safely and effectively helps relieve pain and improve the body’s overall function … [and] uses various treatments depending on your needs, from manual hands-on adjustment techniques to soft tissue therapy.”

Chiropractors treat neck pain, back pain, arthritis, certain types of headaches, injuries and more. They are spine, muscle and nervous system specialists in assessing, diagnosing, treating and developing care plans to keep you moving and pain-free.

| Chiropractor | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Annual Maximum | $300 | $400 | $500 |

This benefit rounds out the top three for both number of claims made and dollars spent in the Professional Services category in the ELCIC Plan.

Physiotherapist, Athletic Therapist, or Kinesiologist

Here is a brief description of how can each these professional services might help you. While there are similarities in the therapy they provide, the variation of focus and approach provides options that might produce a better result for your situation. The websites for each of their associations includes a search for a professional in your area.

| Physiotherapist, Athletic Therapist, or Kinesiologist | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Maximum for these therapists combined | $300 | $400 | $500 |

Physiotherapist: The Canadian Physiotherapy Association notes that “Physiotherapy professionals provide essential rehabilitative care and treatment, enabling Canadians to live well and actively participate in all facets of their lives.”

Athletic Therapist: As noted on the Canadian Athletic Therapist Association website, Athletic Therapists are often “the first to respond when someone gets hurt… they are experts at injury assessment and rehabilitation.” This includes expertise “in the prevention and rehabilitation of injuries to your muscles, bones and joints… as well as concussion recognition, management, and safe return-to-play protocols.”

Kinesiologist: “Kinesiologists apply exercise and movement science to promote health and wellbeing; prevent, manage and rehabilitate injuries; treat illness and chronic disease; restore function, and optimize human performance in the workplace, clinical settings, sport and fitness.” — Canadian Kinesiology Alliance website.

Naturopath & Osteopath

ELCIC plan members and dependents logged 34 visits to a Naturopath and 15 visits to an Osteopath in 2022, which are relatively low numbers and a decrease from prior years. Perhaps current Plan Members are not familiar with what these professional services can offer them.

| Naturopath & Osteopath | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Maximum for these therapists combined | $300 | $400 | $500 |

According to the Canadian Association of Naturopathic Doctors website, three types of patients generally seek naturopathic medical care:

- those who are looking for health promotion and disease prevention strategies

- people who have a range of symptoms that they have been unable to address on their own or with the help of other medical practitioners

- patients who have been diagnosed with an illness and are looking for treatment options

Here’s their description of naturopathy: “Naturopathic medicine is a distinct primary health care system that blends modern scientific knowledge with traditional and natural forms of medicine. The naturopathic philosophy is to stimulate the healing power of the body and treat the underlying cause of disease. Symptoms of disease are seen as warning signals of improper functioning of the body and unfavourable lifestyle habits. Naturopathic Medicine emphasizes disease as a process rather than as an entity.”

The Canadian Osteopathic Association, meanwhile, offers this definition of their field: “Osteopathic medicine, or osteopathy, is a complete system of health care emphasizing a whole person approach to medicine. [These] physicians [have] comprehensive medical and surgical training and special skills in musculoskeletal diagnosis and treatment; [they] make use of all modern diagnostic and treatment modalities, including unique manual treatment principles known as ‘osteopathic manipulative medicine.’ “

Podiatrist & Chiropodist

If you are wondering what the difference is between a podiatrist and a chiropodist, you are not alone. These professions have a similar focus. In Ontario, those who came to the province before 1993 are referred to as podiatrists, while those who came after 1993 or who have been educated in Ontario are called chiropodists. (Source: Ontario Society of Chiropodists.) In other provinces, podiatrists are more common.

The Canadian Podiatric Medicine Association describes podiatry as “a field of medicine that focuses on preventing, diagnosing, and treating conditions associated with the foot and ankle by medical, surgical or other means.”

Chiropodists manage acute and chronic conditions affecting the foot. The Michener Institute of Education that hosts Canada’s only English-language chiropodist program suggests that these conditions can include diabetes, sports and traumatic injuries, biomechanical disorders, ulcers and pediatric foot conditions.

| Podiatrist & Chiropodist | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Maximum for these therapists combined | $300 | $400 | $500 |

Other Practitioners

Four other types of treatments that are covered are fairly self-explanatory:

Licensed Acupuncturists use knowledge of Traditional Chinese Medicine to treat various conditions by inserting thin needles into specific areas of the body.

Speech-Language Audiology Canada describes Audiologists as “hearing health professionals who identify, diagnose and manage individuals with peripheral or central hearing loss, tinnitus, vestibular and balance disorders and other communication disorders across the lifespan.”

Dietitians are trained to provide expert nutrition advice.

Speech-Language Pathologists (commonly known as Speech Therapists) are health professionals who identify, diagnose and treat communication and swallowing disorders across the lifespan. (Source: Speech-Language Audiology Canada)

| Acupuncturist, Audiologist, Dietician, Speech Therapist | Blue | Green | Teal |

|---|---|---|---|

| Plan coverage | 60% | 70% | 80% |

| Maximum for Acupuncturist | $300 | $400 | $500 |

| Maximum for Audiologist | $300 | $400 | $500 |

| Maximum for Dietician | $300 | $400 | $500 |

| Maximum for Speech Therapist | $300 | $400 | $500 |

Conclusion

Taking advantage of the Professional Services offerings in the ELCIC Benefits Plan can have a positive impact on your overall health and wellness. Don’t miss out!

Why Sleep Matters

It’s an hour after midnight on Sunday morning, and you know you should be sleeping. But you also know that you aren’t going to feel up to finishing the sermon before service in the morning, so you make another pot of tea and soldier on.

Or … you managed to get to bed by 11, but there are simply too many things to worry about and now, two hours later, you’re still wide awake and regretting that morning will come too soon.

Or … you went to bed at 9:30, as you like to do, but to your annoyance you woke up just after midnight and now can’t get back to sleep.

Why is It So Hard to Sleep?

Although we are all well aware that sleep is essential, many challenges of modern society make it hard to get enough. Most Canadians spend many hours a day looking at screens — for work, for entertainment, for information, and even for communication. Artificial lighting throws off our circadian rhythms and can leave us alert at night and sleepy mid-afternoon. A nutrient-deficient diet and not enough exercise interferes with many body systems, including sleep. Medications and alcohol consumption can both contribute to poor sleep.

Many members of the ELCIC Benefits Plan find their sleep disrupted by yet another cause: stress. Rostered leaders and often even non-rostered employees find themselves responding to crises in their congregations or communities at all hours of the day and night. There are many evening meetings and church-related events that must be attended. The labour of tending to others’ concerns can be mentally and physically exhausting. And often, there is simply too much that must be done and too few people to do it.

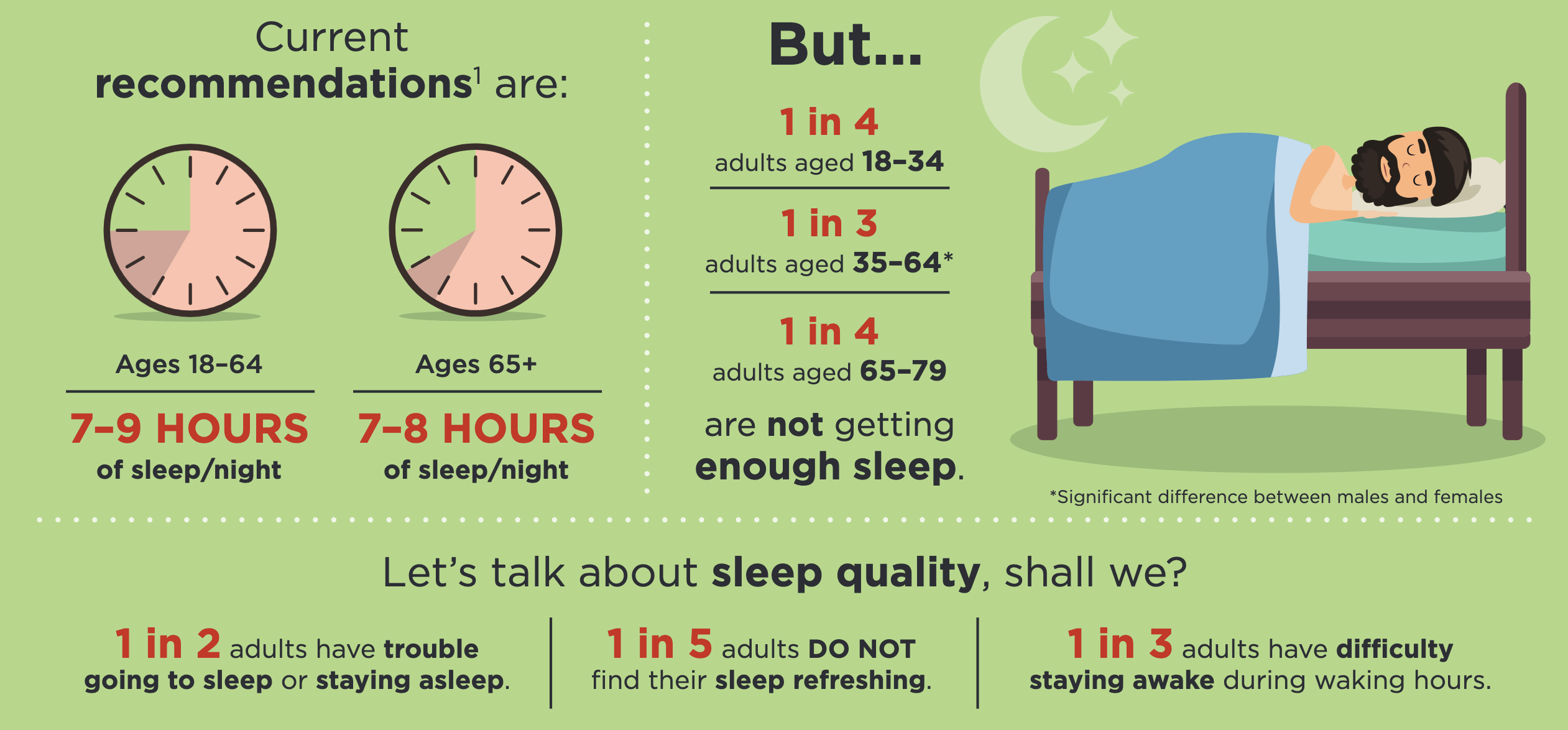

Infographic source: Public Health Agency of Canada

Why is Sleep Important?

People who are able to get enough sleep feel more energetic and alert. Lack of sleep, meanwhile, has many negative health outcomes. The Sleep on It campaign launched by the Canadian Sleep Society (and other experts) lists these consequences of chronic poor sleep:

- Severe fatigue and headaches

- Increased risk of diabetes, obesity, and cardiovascular diseases

- Premature aging of the hair and skin and reproductive system (fewer sperm count)

- Increased risk of anxiety, burn-out and depression

- Attention deficit and memory loss – major implications for school and work performance

- More likely to fall asleep while driving and have poor reflexes behind the wheel – major safety issues

We are only now learning about why, exactly, good sleep is essential to a healthy brain. Studies have identified links between poor sleep in middle age and later development of dementia as well as other cognitive problems. It seems that when we sleep, harmful toxins are removed from the brain; if there’s no sleep, the toxins accumulate. Dreams seem to help us consolidate memories and regular emotions.

What is the Solution?

Given all the factors conspiring against our good sleep, how can we possibly achieve it?

The Canadian Sleep Society has good suggestions for improving sleep at all stages of life. Exercise and meditation can help. So can improving general wellness (perhaps by making use of Professional Services through your benefits plan!). For some people, a short afternoon nap is restorative. Your sleeping area should be dark and cool. Resisting the urge to read on a phone or tablet in bed can improve sleep. In some cases, a medical issue, such as sleep apnea, may be disrupting sleep; it’s worth working with your doctor to see if that’s the case. Reducing stress is vitally important.

We are moving past the days in which getting by on four hours of sleep per night was considered something to brag about. Getting good sleep — in quantity and quality — is difficult for many of us, but everyone benefits from each of us having it. One short night is okay, but if you’re finding that they have become a regular thing, your future self will thank you for making some changes. Good night!

Year-End Opportunity to Change Benefits Module

As we move to the end of the year, members will have the opportunity to reflect on their benefits needs and select their benefits module option that would start on January 1st. Members can move to an adjacent module (e.g., from green to teal) by filling in a Group Benefits Enrollment form and submitting it to the GSI office by Monday, December 18, 2023.

Health module premiums will be posted on the GSI website in early November, so that you and your congregation will be able take those into consideration when making the decision.

Note that if a change is made, members’ claims history will be carried forward. This means that benefits with coverage maximums that extend over more than one year (e.g., vision care at 24 months) will not refresh until the time is lapsed (the 24 months in this example).

Goodbye Vitality — Hello Manulife Mobile

Manulife has announced that they will be retiring their stand-alone Manulife Vitality Group Benefits app early in 2024.

Manulife has announced that they will be retiring their stand-alone Manulife Vitality Group Benefits app early in 2024.

It will be replaced with a new Manulife Mobile app, which will also include your other benefits information. The full description of the app’s capabilities will be available in the coming months.

If you have earned rewards, you can still redeem them. To save a reward outside of the app (if you aren’t able to redeem it before the app is retired), just can take a screen shot of your gift card or Expedia® discount code.

Upcoming Webinar: Neurodivergence in the Workplace

Ask an Expert Question: “I operate differently than those in my workplace. I’ve been told I’m neurodivergent. What does that mean, and how do I fit it?”

Date: Wednesday, October 18

Time: 12:00 – 12:30 PM EDT

Description: Creating healthy workplaces includes fostering inclusivity and accommodating diverse needs. Join CloudMD this month to learn about neurodivergence in the workplace and individuals who experience ADHD, autism and more.

Accessing EAP

Our EAP (Employee Assistance Program) provider, Humanacare, has been undergoing some changes as its integration with CloudMD progresses.

The front page of the Humanacare website currently directs visitors to the CloudMD website. Our rep suggests that those who wish to access EAP instead go straight to the EAP login page: https://humanacare.com/humanalife/

Another upcoming change is the rebranding of Humanacare to their new name, Kii. The grey box below features some information they’ve sent us about their future plans:

We are excited to announce that HumanaCare will be re-branding to Kii, CloudMD’ s new integrated health and wellness program!

Over the last few years, CloudMD has brought together leading organizations in the delivery of mental, physical, and occupational health services. Now, through our fully integrated program Kii we can provide these services to employees and organizations in a seamless and connected experience.

Over the next little while, we are excited to start transitioning all customers from these legacy brands to the new program.

Going forward, you will start seeing the new Kii branding across various touchpoints, including social media platforms and marketing collateral. We are confident that this fresh and dynamic look will generate excitement.

While the name and visual identity will change, our unwavering dedication to delivering excellence and serving our customers with the utmost professionalism remains the same. The rebranding process has been meticulously planned, and we have taken every measure to ensure a seamless transition.

We are excited about these changes and look forward to continuing to provide you with the highest level of service and support.

Have a Question for GSI?

We welcome your questions and feedback!

Information and resources can also be found on the GSI website.

GSI Website: elcicgsi.ca

Winnipeg Residents: 204-984-9181

Toll Free: 1-877-352-4247